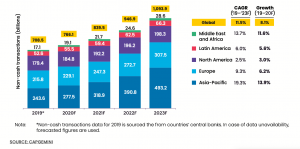

Recent statistics and future predictions by Cap Gemini show that the volume of global non-cash transactions are set to grow year on year, with 11.5% global growth from 2019-2023. Growth of transactions from 2020-21 alone is predicted to be 73.4 billion, a 9.6% rise.

Breaking this down further, Asia-Pacific is by far the front-runner of all, with the Cap Gemini data suggesting the regional giant being responsible for 45% of all global non-cash transactions by 2023.

With fintech start-ups offering businesses and consumers increasingly innovative alternatives to traditional banks, mobile technology becoming more affordable and available and therefore increasingly ubiquitous with digital wallets and mobile payments now the norm, and of course the race towards digitisation due to the unprecedented coronavirus pandemic accelerating the pull from consumers for non-cash convenience, an already disrupting market is set to erupt.

But what is new or different about non-cash payments for the year ahead?

Key trends in non-cash payments in 2021

Delving beneath the Cap Gemini statistics lies a rather more dynamic growth picture in 2021 than we have seen to date. Whilst it is a given that non-cash transactions will only increase – the eventual cashless society is now a widely held assumption – the types of transaction and the technology and regulation that enables them is transforming faster than ever before. Here we look at some key drivers of change:

Continued impact of COVID-19 – touchless payments

The pandemic has changed spending habits, by not only fast-tracking existing trends towards digital channels and payment methods, but also instigating consumers to try contactless payments for the first time, who might never have done. Cap Gemini reports 41% of cash users trying contactless due to the pandemic. So, whilst the pandemic may be temporary, it is still expected to last well into 2021 and can only expedite these trends further. As customers enjoy these payment experiences these habits will stick, so, even once the pandemic has passed, contactless will have further earned its status as a convenient and trusted way to pay. However, we must also acknowledge the hard reality that it has also created other issues the unbanked or underbanked that are unable to make purchases due to the increase of merchants that are today only accepting cash.

Growth of “Buy Now Pay Later” (BNPL)

The e-payments landscape, in particular credit cards, is being subject to significant disruption by BNPL lending (e.g. Klarna and Afterpay). Nowadays more consumers, particularly millennials, are not keen on carrying debt, so BNPL lending offers a scheduled and short-term more appealing borrowing alternative. This will increase further in 2021 which is likely to also see small businesses increasingly demanding BNPL solutions.

Collaboration of fintech startups and established financial institutions

The evolving payments industry is constantly being redefined, not least in the growth of legislation, which presents a complex challenge to fintech startups, in addition to the fierce competition for VC funding. On the flip side, traditional financial institutions face different challenges as their infrastructures delay their ability to adapt and innovate. The answer? Many are increasingly joining forces. In fact PwC sees 82% of current financial service providers increasing such partnerships in the next five years.

Evolution of open banking

Open banking, although to date largely untapped, is a game-changer for the financial services industry, with the biggest winners of all being fintechs as the development of new financial products is becoming faster and easier. Key to unlocking the opportunities of open banking is Banking as a Service (BaaS), the end-to-end-model that enables access to a bank’s data systems via APIs. Here enters the Fintech-as-a-Service concept. In 2021 we will see more fintechs not only utilising the services they can now gain access to, but also providing the platform that enables other third parties to benefit from the open banking revolution.

2021 – A promising year ahead for fintechs

The key trends we have touched on here all point to a promising year 2021 for fintechs. At TransactPay we are particularly seeing increasing activity around borrowing, with more fintechs looking to launch credit products, particularly for corporates. One to watch will be fintechs offering more and more creative, intelligent, and innovative borrowing solutions, amalgamating the best principles of two breeds: credit cards and BNPL.

The possibilities, in partnership with an experienced BIN sponsor like TransactPay, are endless.

Details

Date

17 Feb 2021

Category

Thought Leadership

Author

TransactPay